seattle payroll tax proposal

The JumpStart payroll expense tax provides services to Seattles low-income population. Seattles city councilor at least a few of its membersare again gearing up for an effort to increase taxes on the citys largest employers.

Project Proposal Outline Project Proposal Template Proposal Templates Business Proposal Template

The tax bill was adopted largely unchanged from the form in which it was voted out of committee last Wednesday but two amendments narrowly passed.

. This figure is not in writing in Scotts own plan nor is it even from someones analysis of a specific policy Scott laid out in his plan document. 1 while the so-called jumpstart tax is currently awaiting signature by seattle mayor jenny. Employee Z works for Beta Corp and has an annual salary of 160000.

The payroll tax proposal dwarfs the. It is estimated it will generate about 200 million. Under the new proposal announced Tuesday Mosqueda wants.

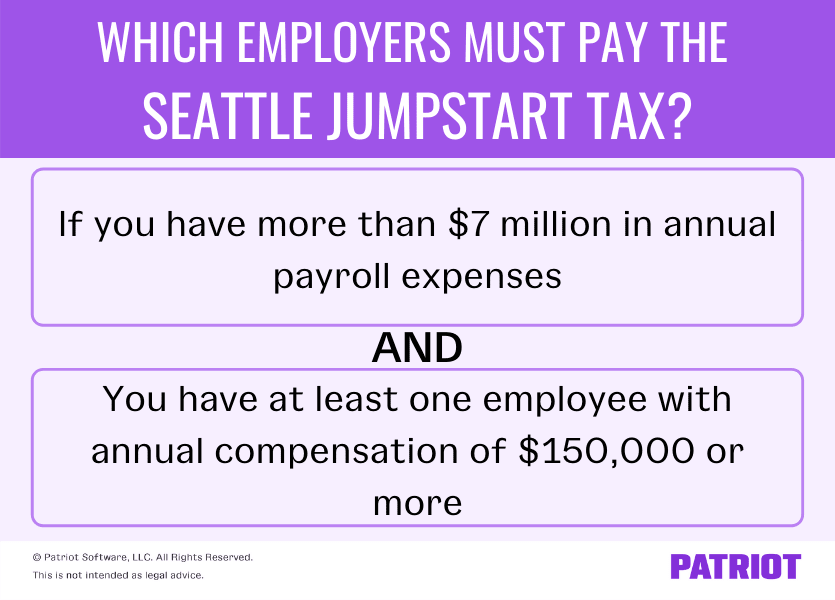

Compensation package and is considered compensation for the payroll expense tax. The draft rules address areas of ambiguity in the ordinance adopted by the Seattle City Council in July see PwCs Insight for more on the new payroll expense tax law. Businesses pay the tax for each employee who makes 150000 a year or more.

Get Started With ADP. On July 6 2020 the City of Seattle City Council approved the JumpStart Seattle Plan Council Bill 119810 CB 119810 1 which imposes a payroll expense tax on persons engaging in business within SeattleThe JumpStart Seattle Plan focuses on the COVID-19 crisis and Seattles long-term economic revitalization by investing in affordable housing and other. 07 of annual salaries between 150000-399999.

This morning Council member Kshama Sawant unveiled her proposal for a new payroll tax in Seattle independent of and possibly on top of one already proposed for King County. 1 applies to businesses with annual payroll costs of at least 7 million. On 07062020 Kevin Schofield In tax This afternoon the City Council passed by a 7-2 vote the much-touted Jump Start Seattle payroll tax proposal with a couple of last-minute amendments.

Compare the Best Now. Employee Ys totalpensationcom for purposes of Able Corps payroll expense tax is 180000 160000 salary 20000 vested RSUs. This carefully crafted revenue proposal is thoughtful in its requirement that only the largest companies with the highest salaries pay the tax and it ensures predictability for businesses if there is a regional.

Those efforts and a general backlash from much of the business community managed to keep a Seattle payroll tax at bay until this summer. Businesses with at least 7 million in annual payroll will be taxed 07 to 24 on salaries and wages spent on Seattle employees who make at least 150000 per year with tiers for various payroll. The payroll tax co-sponsored by Seattle City Councilors Tammy Morales and Kshama Sawant would impose a 13 tax on some of the citys biggest businesses.

Backers of a proposed Seattle payroll tax now see it as a revenue cure to the pandemic-induced 210 million to 300 million hole in the city budget. Businesses pay the tax for each employee who makes 150000 a year or more. June 16 2020.

The new JumpStart Seattle payroll expense tax is in effect as of January 1 2021. A lawsuit has been filed challenging the Seattle tax and there is a draft. The company pumped a record 15 million into council races last year.

The Seattle Payroll Tax. Employers with annual payroll expenses of more than 1. On July 6 2020 the Seattle Washington city council approved a new payroll expense tax for certain businesses operating in Seattle.

The seattle city council recently approved a new payroll expense tax which will apply to businesses operating in seattle with at least 7 million in annual payroll at a rate of 07 -14 on employee salaries over 150000 beginning on jan. 19 hours agoFacts First. The tax which many have seen as a cure in search of a problem has now found a new problem.

The council voted unanimously Monday to review legislation proposed by Councilmembers Kshama Sawant and Tammy Morales that would impose a 13 payroll tax on most companies with more than 7. 1 applies to businesses with annual payroll costs of at least 7 million. The Seattle payroll tax which took effect Jan.

Find 10 Best Payroll Services Systems 2022. The Seattle payroll tax which took effect Jan. Ad The New Year is the Best Time to Switch to a New Payroll Provider.

Under the new proposal announced Tuesday Mosqueda wants. Seattle has proposed rules for its new payroll expense tax that took effect January 1 2021. Businesses pay the tax for each employee who makes 150000 a year or more.

The 2018 revised tax base was increased by 139 the difference between the 2018 ESD and the Seattle-wide compensation base used to develop HB 2907 a state payroll tax proposal. Bidens framing of this nearly 1500 per family figure was misleading. Adjustment was applied.

The new JumpStart Seattle payroll expense tax is in effect as of January 1 2021. Employers in the first bracket will be taxed. After applying this adjustment the inflated 2021 tax base is 438 billion.

The Pacific northwest news nonprofit Crosscut explains the Seattle payroll tax which passed in July. SEATTLE Seattle City Councilmember Teresa Mosqueda is proposing a payroll tax that she says could generate as much as 200 million a year. 1 applies to businesses with annual payroll costs of at least 7 million.

One hammer many nails. The targets of the proposed taxes have been constant. Rather the figure is a rough estimate from the Tax Policy Center of an entirely.

Two years ago Amazon even temporarily halted construction on one of its Seattle office towers in protest of a proposed payroll tax. David Kroman reports in Crosscut. Ad Process Payroll Faster Easier With ADP Payroll.

Discover ADP For Payroll Benefits Time Talent HR More. She said that her proposed tax would raise 300 million annually of which 75 would be used for affordable housing and social services and 25 for converting existing homes from. 17 of annual salaries exceeding 400000.

The JumpStart Seattle plan proposes a tax on corporations with payrolls of 7 million or more and employees with salaries of 150000 or more. Jared Walczak Maxwell James. The JumpStart Seattle tax took effect on January 1 2021 and currently has an end date of December 31 2040.

Backers of a proposed Seattle payroll tax now see it as a revenue cure to the pandemic-induced 210 million to 300 million hole in the city budget. Affordable Easy-to-Use Try Now. The nature of the tax and what it is intended to fund has been a moving target.

SEATTLE The Seattle City Council is considering a 500 million payroll tax that would be immune from a voter referendum.

But I Thought Rich People Don T Pay Taxes Steemit Rich People Paying Taxes Thoughts

Seattle City Council Unveils New Payroll Tax Targeting Amazon And Other Large Companies Geekwire

Http Ygacpa Com Small Business Business Extra Income

Policy Basics Federal Payroll Taxes Center On Budget And Policy Priorities

Understanding The Mayor S Proposed 2022 Budget Part Ii The Payroll Tax

Seattle S Payroll Expense Tax On Salaries Of Top Earners Bader Martin

Understanding The Mayor S Proposed 2022 Budget Part Ii The Payroll Tax

Washington S Long Term Care Payroll Tax And How To Opt Out Alterra Advisors

Seattle City Council Unveils New Payroll Tax Targeting Amazon And Other Large Companies Geekwire

Seattle City Council Unveils New Payroll Tax Targeting Amazon And Other Large Companies Geekwire

Seattle A Step Away From Approving New Progressive Revenue Tax On Big Businesses To Help Overcome Covid 19 Budget Crisis Chs Capitol Hill Seattle

Washington State Retools First In Nation Payroll Tax Plan For Long Term Care Costs 90 5 Wesa

Understanding The Mayor S Proposed 2022 Budget Part Ii The Payroll Tax

New Seattle Jumpstart Tax Overview Rates More

City Council Completes Framework For Seattle S New Tax On Largest Companies With Fund For Housing Small Business Green New Deal And Equitable Development Chs Capitol Hill Seattle

Another Payroll Tax Anyone Steemit Payroll Taxes Payroll Weekly Pay

Understanding The Mayor S Proposed 2022 Budget Part Ii The Payroll Tax

Pin By Pak Hills On Blooms Taxonomy Thank You Letter Template Thank You Letter Sample Sponsorship Letter